Coopertown Property Tax For Fire Protection Nears Final Reading

COOPERTOWN TENNESSEE: (Smokey Barn News) – Coopertown is just days

away from a financial solution to a fire services issue that, according to Coopertown Mayor Sam Childs, had the potential to bankrupt the city.

Back on May 22, Mayor Childs told Smokey Barn News that the city of Coopertown was facing a “Critical moment that could collapse the city.” Now almost five months later the city has a solution within its grasp.

The issue, finding the money in city coffers to pay for the rising cost of fire protection services for the city. Since 1970 Coopertown has entrusted its fire protection services to Pleasant View Volunteer Fire. The services are supplied under four year contracts and the current contract will expire soon.

In the most recent contract, Pleasant View Fire has asked for an increase that will, in essence, more than double the fee the city pays over a three year period, Childs said. Pleasant View Fire Chief P. J. Duncan said the increase is long over due and needed if they are to provide proper fire protection services to the Coopertown Community. In an interview with Smokey Barn News back in May, Mayor Childs said the increase in fees will bankrupt the city under the current budget.

Mayor Childs made it clear back in May that he was not happy about the new fees but eventually conceded to their inevitability. Childs did negotiate some financial concessions in the contract with Pleasant View Fire but only for the short term, Childs needed a permanent solution.

After months of looking at numerous ways to find the money, Childs and the Board of Mayor Alderman concluded that a small property tax was the only way out.

On September 14 a special meeting was called to consider a 35 cent property tax, it passed the first reading.

The second reading will be held on September 27. If it passes the second reading it will become law. “I anticipate it will pass that reading as well,” said Mayor Childs.

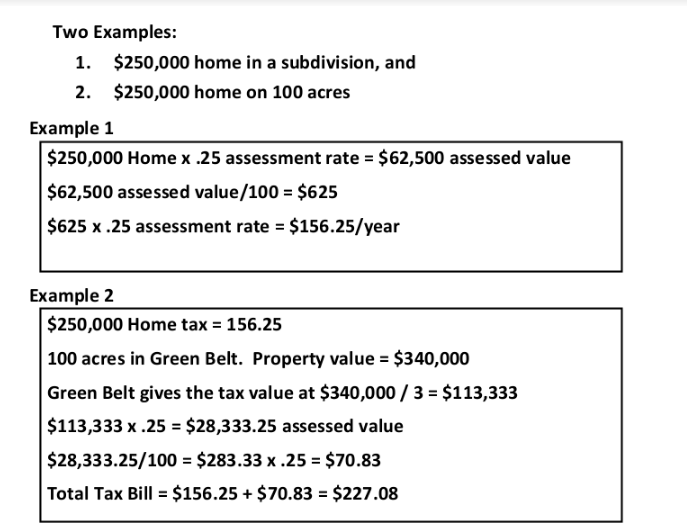

If you live in Coopertown, here’s the breakdown.

Mayor Childs expects the new property tax to bring in about $217,000 annually.

Here’s a rough look at Coopertown’s current budget. Coopertown currently gets $30,000 to $45,000 in building permit fees, sales tax is about $100,000, state shared revenue totals about $325,000, gas tax is roughly $100,000 and the Coopertown Barrel Festival nets about $6000, which is spent on community development activities and the restoration of the Frierson Chapel Church as well as other projects.

Along with other miscellaneous taxes, Coopertown operates on just a little over $800,000 a year. If the new property tax passes the final reading on September 27 it will push the city just over a million.

Childs also said that any any money left over from the fire tax will go into improving the city’s roads, that, according to Childs, are horrible..

Childs is hoping the city will not have to raise the tax for quite some time.

Related Stories:

Coopertown Fire Services-> “Financial Time Bomb” Mayor says.. A Full Report…

Coopertown Closer To Contract With Pleasant View Fire

Smokey Barn News (Sponsor/Advertisement)

We bring you ALL the News in and surrounding Robertson County, Tennessee.

hay I am not from your county of Robertson Tn. I am from Monroe Mi. this new fire tax for your fire department is a vary low cost compared to what the Men and Women in your community pay with their limbs and life,quite winning.when you property and I really hope it never happens .It did to me in 1993 good insurance good 911 service and an awesome well payed for fire department showed up and put our fire out .There is nothing worst then seeing YOUR home go up in flames .I am a parent of a First Responder. He never thinks of his own safety he knows there is a job to do and that is to run into a burning building to save a human life. give no care for his .He is a Husband A father of 2 girls and MY SON .going in to help people in our community during THEIR time of need.remember your time could at any time not just house fires but entrapment in a accident a medical emergency such as STROKE or HEART attack.THINK about it would YOU be welling to do what these men and women do . If you do not help with your taxes you may not have the staff to support your community when it is in need.I know who well be the first to ask where is the fire department it well be those who appose you fire departments funding

God bliss

Ronald S.Guyor Sr.

It’s not based on property value as in an appraised value…it is the tax assessment (and that is generally based on the property (land) value, not the structure(s) on the property. Example, we paid $114,900 for our home 18 years ago and although the appraised value has almost doubled, our annual tax assessment that we pay Robertson County taxes on has always been assessed at $26500 to $28000. Our annual County property tax has ranged from $696 to $836 during the 18 years we have been here. If Cooopertown uses the same assessment (which it sounds like that is the case)…our “tax” should be just below $100.

Yes I have sent my response to mayor child’s concerning this increase to have a flat tax where it is equally divided among all residents that goes directly to the fire department. I have paid the recommended fund raiser fee every year that we received from PVfD. They said if everyone did it would cover the costs. So instead of 120 a year we are paying five times as much This is because I live in the pebblebrook subdivision where the city does not provide any service inside the gates such as pot holes or street conditions. So the average property value in the neighborhood is over 350000. So we will paying an extra 1000 a year for fire service